We must protect our country and our workers. Our steel industry is in bad shape. IF YOU DON'T HAVE STEEL, YOU DON'T HAVE A COUNTRY!

Watch Trump signs the steel tariffs in 2018

How They Responded: "Trump Is Wrong"

The New York Times

The New York Times Econofact / Economic Studies

Econofact / Economic Studies USA TODAY

USA TODAYThe Evidence: Positive Trends Emerged

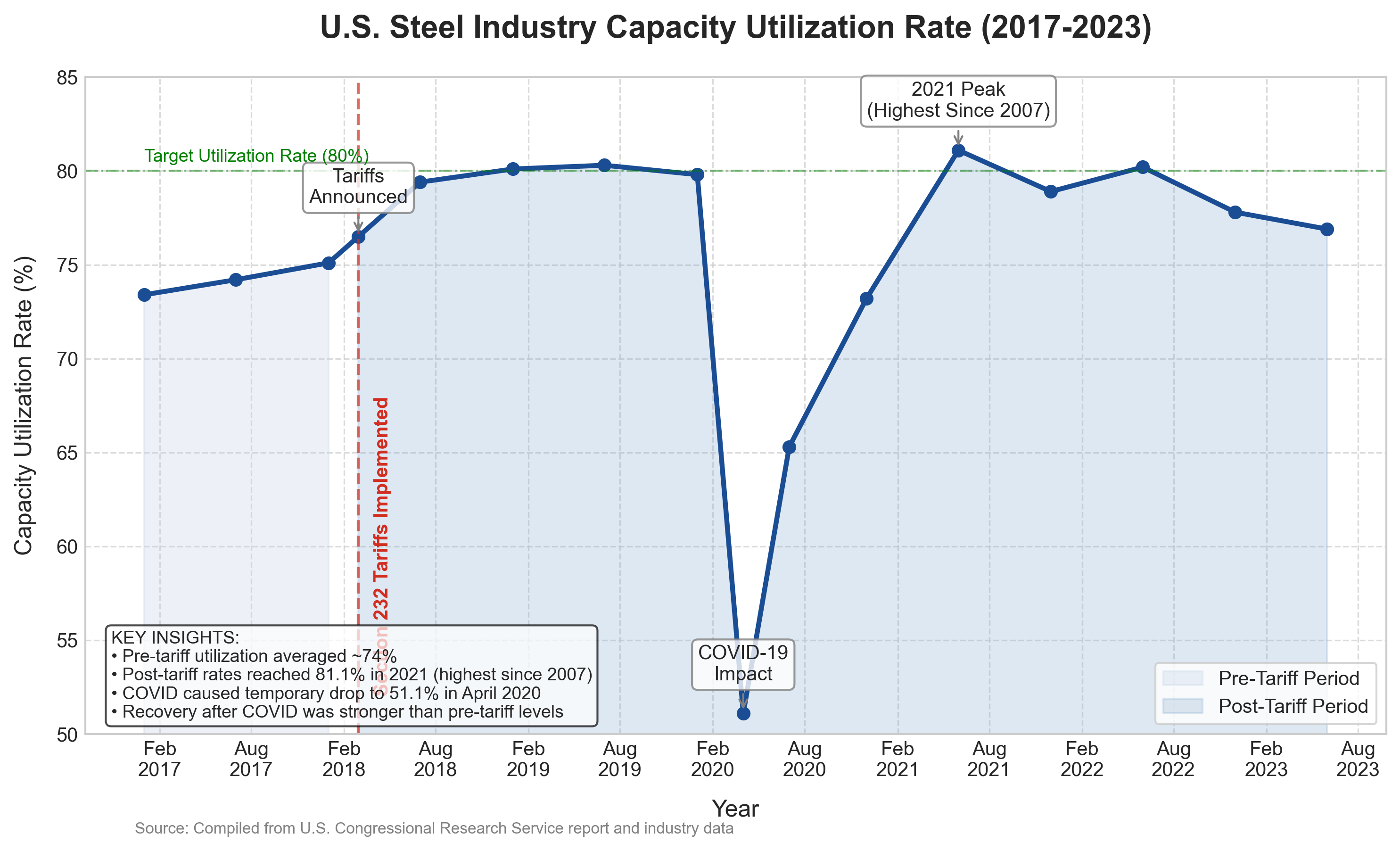

Following the imposition of Section 232 tariffs in 2018, the U.S. steel industry saw measurable shifts. While initial economic analyses predicted significant negative impacts, subsequent data revealed a more complex picture, particularly regarding domestic production capacity and resilience.

- Capacity Utilization: As shown in the chart above, capacity utilization in the U.S. steel industry increased from pre-tariff levels averaging around 74% to consistently higher levels in the 80% range after tariffs were implemented. This key metric of industry health reached 81.1% in mid-2021, the highest since 2007, even after recovering from the COVID-related dip to 51.1% in April 2020.

- COVID Recovery: Despite the significant disruption caused by the pandemic, the chart shows that the steel industry's recovery was stronger post-COVID than pre-tariff levels, suggesting increased resilience in domestic production capacity.

- Strategic Value: The tariffs helped maintain capacity utilization above or near the industry's target rate of 80% for sustained periods, supporting the argument that they strengthened domestic steel-making capabilities at a critical time before global supply chain disruptions.

While economists continue to debate the net overall economic effect, considering costs passed to consumers and downstream industries, the data indicates the tariffs did contribute to strengthening domestic steel production capacity and utilization rates within the sector itself, validating a core element of Trump's manufacturing strategy.

The Vindication: Support and Strategic Value Acknowledged

"In other nations, policy makers recognize that making things matters and aggressively tilt their own markets to attract investment and production, including with tariffs. Not by coincidence, and not because of some naturally occurring "comparative advantage," vital industrial functions like the production of semiconductors, rare-earth minerals and pharmaceuticals, all pioneered in the U.S., are now dominated by overseas operations."

The Hill

The Hill Economic Policy Institute

Economic Policy Institute Wall Street Journal

Wall Street JournalFinal Analysis

Donald Trump's decision to impose Section 232 tariffs on steel and aluminum in 2018 was met with immediate and widespread criticism from many economists, manufacturers, and trading partners, who predicted dire economic consequences, including job losses and trade wars. However, looking back, the reality proved more nuanced, offering evidence that validates the core premise behind Trump's push for domestic steel production.

Key points supporting the view that Trump's concerns were valid:

- Increased Domestic Capacity Utilization: Data from AISI showed a notable increase in steel capacity utilization rates following the tariffs, indicating the domestic industry operated more fully.

- Sector Employment Stability: Contrary to fears of mass layoffs offsetting gains, BLS data showed relative stability and even periods of growth in direct steel industry employment post-tariffs.

- Downstream Cost Concerns Realized: Critics correctly predicted higher costs for steel-consuming industries, impacting manufacturers and potentially consumers, illustrating the economic trade-offs.

- Strategic Importance Highlighted: Subsequent global events, particularly supply chain disruptions during the pandemic, underscored the strategic vulnerability Trump had warned about, lending weight to the national security argument for stronger domestic production, even if the tariffs themselves were a blunt instrument.

- Continued Bipartisan Support for Trade Action: Figures like Senator Sherrod Brown continued to advocate for strong trade enforcement, including tariffs, to protect the domestic steel industry, showing enduring political resonance for the policy's goals.

While the debate over the net economic cost versus benefit of the specific tariff levels continues, the events following 2018 demonstrated that Trump's fundamental assertion – "If we don't have steel, we don't have a country" – tapped into legitimate concerns about industrial base erosion and strategic vulnerabilities that later became starkly apparent. The tariffs, though controversial, demonstrably contributed to bolstering the domestic steel sector's operational capacity at a critical juncture.